In the evolving landscape of financial transactions, the humble check continues to hold its ground in the United States, albeit with a diminishing presence. The Federal Reserve’s 2018 Payments Study revealed that while check usage has declined, they still represent a significant portion of the payment mix, especially for certain types of transactions. For example, businesses and government entities wrote 60% of all checks in 2015. Despite advancements in digital payment methods, checks, with their traditional appeal and legal solidity, remain a fixture in American financial dealings.

Can You Fold a Check? The Correct Answer

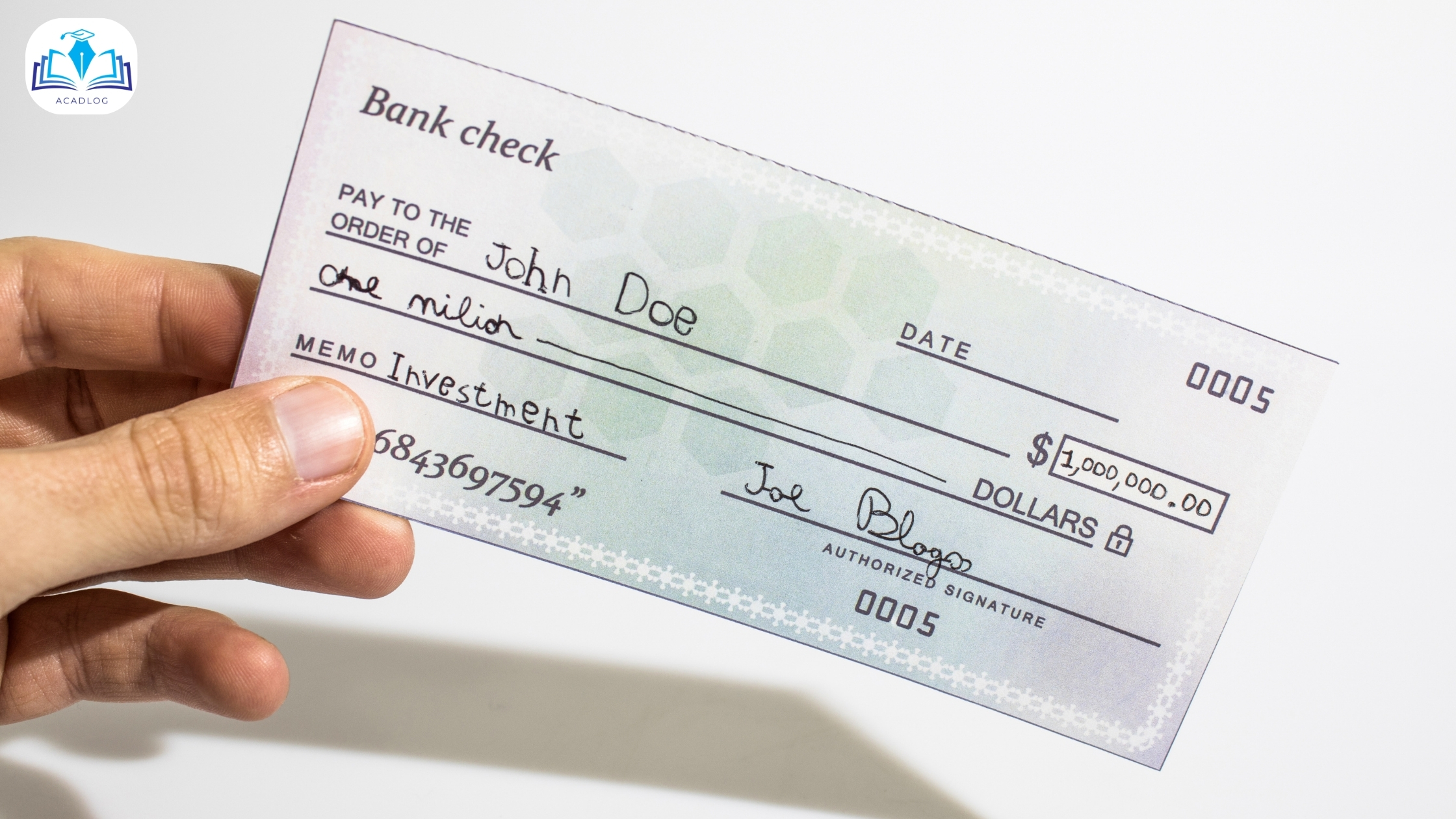

Yes, you can fold a check. However, it is important to fold it in a way that does not obscure or damage any essential information such as the payee’s name, date, dollar amount, signature, check number, bank account number, and the bank’s routing number. The MICR (Magnetic Ink Character Recognition) line, which is essential for electronic processing of the check, should also not be compromised by the fold. Folding a check in half is typically a safe way to do it without causing any issues for processing

The Pros and Cons of Folding Checks

-

Pros of Folding Checks

- Portability and Convenience: One of the most apparent advantages of folding a check is its enhanced portability. For instance, folding a check allows for easy transportation of essential documents like contracts or legal papers within a pocket or a small bag, bypassing the need for bulkier storage solutions. This convenience is not just theoretical; it’s a practical solution that many find helpful in everyday scenarios.

- Protection from Damage: Folding a check can serve as a protective measure. It effectively creates a ‘pouch’ that shields important documents from wear and tear. This aspect is particularly beneficial for documents that have already been marked up or signed, as it helps in preserving their integrity.

-

Cons of Folding Checks

- Inapplicability for Certain Documents: While the practice of folding checks can be advantageous in some contexts, it is not universally applicable. For instance, folding checks that are attached to commercial contracts or personal financial documents could potentially harm more than help. These documents often require meticulous handling and storage to maintain their legal validity and physical legibility.

- Risk of Physical Damage: There’s a tangible risk involved in the act of folding a check. If folded too tightly, it might create a crease too deep, potentially damaging the paper inside the check. Conversely, insufficient folding might leave a fold too shallow, risking damage to the paper’s exterior. This physical alteration could lead to difficulties in processing the check or even render it invalid.

- Accuracy and Security Concerns: A poorly folded check can lead to issues beyond physical damage. For example, incorrect folding might result in a check that doesn’t fit properly in envelopes or scanning machines, leading to processing errors. Additionally, if folding obscures or distorts critical information like the amount, date, or signature, it can raise concerns about the check’s authenticity and lead to processing delays or rejections.

Safety Tips When Folding and Mailing Checks

-

Best Practices for Folding Checks:

- The ideal way to fold a check is in half. This method minimizes the risk of crumpling and ensures that important details such as the payee’s name, date, dollar amount, signature, check number, bank account number, and bank routing number remain visible and intact.

-

Mailing Checks Safely:

- When sending a check through the mail, concealment can be a useful strategy. Placing the check within colored or regular paper, or even within a greeting card, can disguise its presence, reducing the risk of theft or tampering. Moreover, this approach does not necessarily increase the cost of mailing, as it avoids the need for special delivery services.

- Labeling and packaging should be done thoughtfully to ensure the check’s legibility is not compromised. The ink should be dry to prevent smudging, and the check should ideally be placed in a wallet or a book to maintain its flatness and prevent further damage.

-

Ensuring Legibility and Avoiding Damage to the MICR Field:

- The MICR field, essential for the electronic processing of checks, should never be compromised. Avoid folding checks across this field. The clarity of the wording and the integrity of the MICR field are crucial for the check to be processed smoothly by banking systems.

Alternatives to Folding Checks

In an era where digital transactions are rapidly becoming the norm, alternatives to traditional checks are gaining popularity. The Federal Reserve Bank of Atlanta’s 2018 report highlights a significant shift in consumer preferences, with a marked decrease in check usage for both bill payments and purchases.

-

Digital Bank-to-Bank Transfers:

- These transfers offer a secure, quick, and convenient alternative to traditional checks. They eliminate the need for physical handling and the risks associated with it. The growth of online banking and mobile applications has made this method increasingly accessible and popular among all age groups.

-

Money Orders:

- Money orders provide a more secure way to send funds through the mail. They are widely available at post offices, grocery stores, and other locations, making them a practical alternative for those who do not have access to digital banking services.

-

Online Check Services:

- For those who still need or prefer to use checks, online check-sending services offer a secure and fast way to deliver checks without the need for mailing. These services often use advanced technologies like AI and machine learning to ensure accuracy and security in check processing.

Handling Damaged or Folded Checks

Despite the best precautions, checks can sometimes get damaged. However, this doesn’t always mean they are unusable.

-

Depositing Creased Checks:

- Banks generally accept creased checks as long as the crease does not affect the legibility of critical information or the MICR field. The Federal Reserve’s guidelines emphasize the importance of maintaining the integrity of the MICR line for smooth processing.

-

Dealing with Torn Checks:

- Torn checks pose a higher risk. While banks may accept them, there’s an increased likelihood of processing errors. In such cases, it’s advisable to request a reissued check from the issuer.

Precautions to Prevent Check Fraud and Loss

The risk of check fraud remains a concern, with the Federal Reserve’s reports indicating the need for continued vigilance. While checks are less frequently used, their average transaction value remains high, making them a target for fraudsters.

-

Writing Checks Safely:

- Use permanent ink and ensure no alterations or erasures on the check. Begin writing the amount close to the word ‘Dollars’ and end with ‘only’ to prevent tampering.

-

Safe Storage and Handling:

- Keep checks in a secure and locked place. Regularly reconcile your checkbook with bank statements to quickly identify any discrepancies.

-

Fraud Prevention Techniques:

- Consider adding ‘For Deposit Only’ when endorsing checks. Use certified mail for added security when mailing checks.

-

Emerging Technologies in Check Processing:

- Banks and financial institutions are increasingly using technologies like AI and machine learning for check processing, reducing the chances of errors and fraud. These technologies ensure that checks are processed with higher accuracy and security.

Final Words

As we navigate through the changing landscape of financial transactions, understanding the proper handling of checks and being aware of the alternatives and risks associated with them is crucial. While the use of checks is declining, their significance in certain transactions cannot be understated. By adopting safer practices and embracing technological advancements, we can ensure the secure and efficient use of checks.